While everybody knows that buyers shop based on price range, there are many additional considerations to make when looking for a home. And, most buyers end up refining their criteria once they start touring homes. Ultimately, your home criteria should depend on your personal lifestyle and needs. Regardless of what you’re looking for, here are some general rules you should follow to make sure you’ll be happy with the home you buy for the foreseeable future.

What are the top features buyers look for in a home?

Today’s buyers are juggling many different priorities when it comes to buying a home, but according to the Zillow Group Consumer Housing Trends Report 2019, here are the features that rank as very important or extremely important to most buyers.

Neighborhood wants and needs for buyers

- Safety: 82% say a neighborhood that feels safe is very or extremely important

- Walkability: 60% say it’s very or extremely important

- Preferred neighborhood: 56% say it’s very or extremely important

- Proximity to shopping, services and/or leisure activities: 53% say it’s very or extremely important

- Optimal commute to work or school: 52% say it’s very or extremely important

- Offers a sense of community or belonging: 48% say it’s very or extremely important

- Close to family and friends: 46% say it’s very or extremely important

- In preferred school district: 43% say it’s very or extremely important

Home features buyers want

- Within initial budget: 83% say it’s very or extremely important

- Air conditioning: 78% of buyers say it’s very or extremely important

- Preferred number of bedrooms: 76% of buyers say it’s very or extremely important

- Preferred number of bathrooms: 67% of buyers say it’s very or extremely important

- Private outdoor space: 67% of buyers say it’s very or extremely important

- Preferred size/square footage: 67% of buyers say it’s very or extremely important

- Floor plan/layout that fits preferences: 67% of buyers say it’s very or extremely important

1. Search for the right price

Price will ultimately dictate what you can or cannot buy. While looking at homes above your price range can be fun, it’s not a good use of time — and it can lead to heartbreak when you realize it’s not financially feasible. Despite this, Zillow research found that in 2019, just 55% of buyers stayed on budget, while 26% went over their initial budget.

How to set your home buying budget

Use Zillow’s Affordability Calculator: This handy tool gives you an initial budget range based on your income, existing monthly bills, and down payment amount. Once you have that range, you can set up Zillow alerts for homes on the market that fit your price range, along with other criteria.

Get pre-approved: Once you’re ready to really start your home search, you’ll want to get pre-approved by the lender of your choice. They’ll approve you for a loan up to a specific amount, based on your income, debt and credit history.

Forecast your mortgage payment: Even if you are pre-approved for a large loan from your lender, you should make sure you’re comfortable with your estimated monthly housing payment. When you use Zillow’s mortgage calculator to estimate your monthly payments, be sure the taxes, insurance, and HOA fees are accurate — those items can make a big difference in your monthly costs.

2. Prioritize the location

Next to budget, location is one of the most important things to consider when buying a house. The 2019 report uncovered that 24% of buyers found it difficult or extremely difficult to find a home in their desired location. If you can’t find or afford a home in your ideal neighborhood, you’ll want to ask yourself a few questions (and enlist the help of your agent) to find a location that fits your lifestyle, needs and budget. Remember — your home’s location can’t be changed, so take the time to really identify a neighborhood where you’ll be happy live.

Proximity to downtown

Unsurprisingly, homes closer to core downtown areas have better resale value, thanks to their shorter commutes. According to Zillow research, in 29 of the country’s 33 largest metro areas included in the analysis, buyers should expect to pay more per square foot for a home within a 15-minute rush-hour drive to the downtown core. That may be why 15% of buyers who compromise to stay within their budget add time to their commute.

Community attributes

If you like being able to walk to restaurants and shops, try walking the distance to town to see if it’s doable. Spend some time exploring the area, checking out nearby parks and figuring out what kinds of attractions are nearby.

Alternatively, if you’re someone who likes a more solitary life and doesn’t mind driving, you might prioritize a home that offers more privacy, perhaps in a location that’s off the beaten path.

School district quality

If you have kids (or are planning on having kids in the future), you want them to get the best education possible. Checking out the school district ratings is a starting point, but you should visit the local schools to gather your assessment of the education and programs. Even if you don’t have children, the school district that your home is in can impact your future resale value.

Flood zone status

Homes located in flood zones require additional insurance, and buying a home in a flood-prone area means you need to be prepared if a flood actually happens.

3. Think long term

According to the Zillow Group Report, the typical homeowner stays in their home for 14 years before selling. When shopping for a home, don’t just think of your immediate needs. Make sure the home you select will meet your long-term goals, so you won’t have to move again in the near future.

Bedrooms and bathrooms

If you plan to expand your family in the near future, make sure the new home can accommodate your plans, whether it’s an extra room for a new baby, an in-law suite for parents, or a guest bedroom if you’re moving out of state and anticipate lots of visitors. The same goes if you are planning to downsize or you have grown children who will be moving out soon.

Outdoor space

As mentioned above, most buyers rank outdoor space as important. If you have a dog (or plan to get one), have kids who need a safe place to play or are an avid gardener, you’ll want to make sure the home’s outdoor space meets your needs.

Potential to personalize

Many buyers look for a home that’s move-in ready, so they can avoid costly repairs and updates (especially right after moving in). But at the same time, it’s nice to be able to add some personal flair to make a house feel like home. If you’d like to add some of your own style, be sure to steer clear of homes that you won’t be able to change enough to fit your preferences.

Lifestyle amenities

Ideally, your new home should enhance your current lifestyle — and you’ve probably already envisioned what your life in a new home will look like. As you evaluate houses, consider your hobbies and what makes you happy. For example, if you love spending time outdoors, you probably want a home with a nice yard. If you love to cook, maybe a nice, big kitchen is on your wish list. And, think about your current living situation: What things do you wish were different?

4. Assess property condition

TV makes home renovations look easy, but in reality, they’re anything but. If you’re a first-time buyer who has never undergone a renovation, you may want to steer clear of a home in serious disrepair. The costs can add up quickly, and if the home needs structural work, it could delay your move-in, causing unnecessary stress. Here are the three major categories of property condition.

Move-in ready

A move-in ready home is new, close to new, or has been recently renovated. Zillow-owned homes are move-in ready homes that have been recently renovated by a licensed contractor, and are ready for new owners to start their lives.

Minor updates

A home that needs minor updates might have cosmetic issues you’d like to change, or have some dated mechanical systems that could be updated for energy savings. Learn more about minor cosmetic details below.

Major renovation

A home that needs major repairs is usually priced lower due to the work that needs to be done. One upside to a major renovation is the opportunity to personalize the home to your tastes. Keep in mind that the return on investment for a major renovation isn’t 100%, and you risk a delayed move-in if the repairs are more extensive than anticipated.

Check condition of costly systems

No matter the condition of the home you’re buying, make sure your inspector checks to make sure major systems and mechanicals in the home are functioning properly. If issues are uncovered, you’ll want to ask the seller to either repair them before closing or offer a credit so you can fix them yourself. Look out for the following costly issues:

- Damaged roof

- Older furnace or HVAC system

- Flooding, water damage or mold

- Old insulation

- Plumbing issues

- Exterior cracks

- Uneven floors

5. Don’t focus on minor cosmetic details

No house is perfect, so try not to get hung up on little imperfections. For example, don’t eliminate a home from your list just because you don’t like the interior paint color. Cosmetic changes are fairly easy and affordable to make. Don’t let the following minor issues keep you from buying a house you would otherwise love:

- Paint

- Hardware

- Furnishings

- Landscaping

When you attend showings and open houses, or even when you’re just browsing through pictures online, it’s easy to get distracted by clutter. Try not to pay too much attention to the seller’s stuff — it’ll all be removed by the time you move in. Put in the effort to picture the house as a blank canvas for all of your belongings.

6. Stick with your must-haves

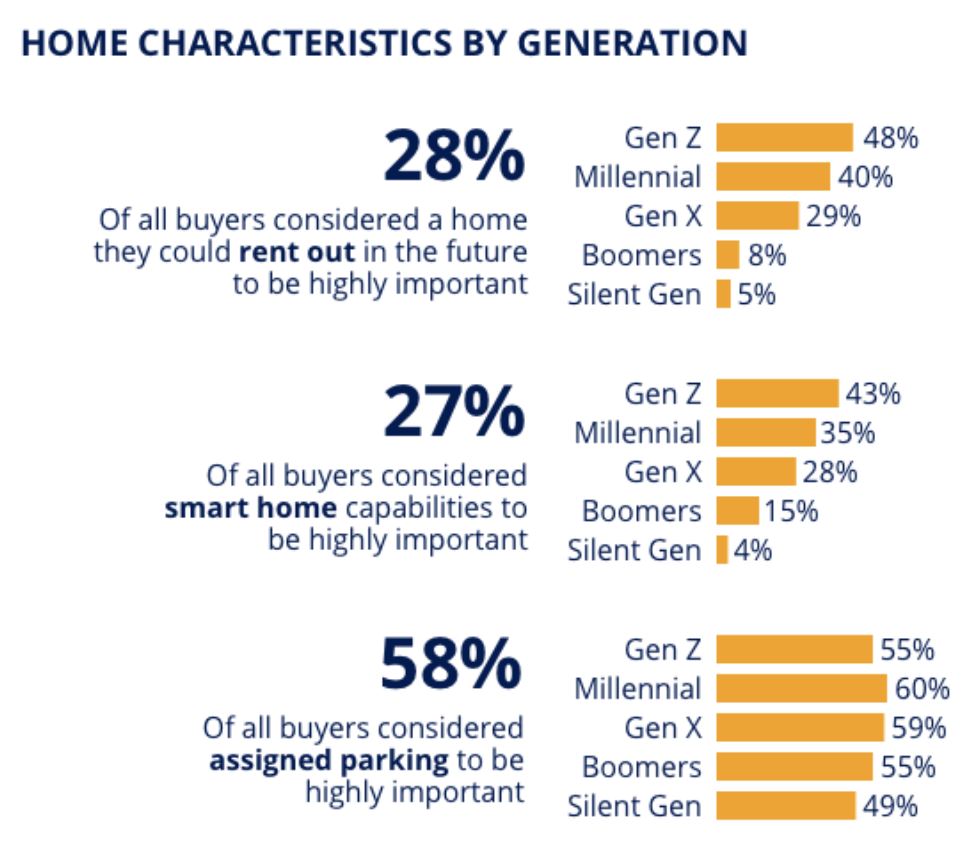

There’s a big difference between wants and needs, so create two different lists when searching for a home. For instance, a shorter commute may be a must-have, but smart home features are a nice-to-have. Practicality and functionality should always take priority over the bells and whistles.

Things to consider when buying a house: needs vs. wants

For example, your list of needs might look like this.

- Need: shorter commute

- Need: specific number of bedrooms and bathrooms

- Need: parking

Other items might fall to your list of wants, like these.

- Want: updated kitchen

- Want: upstairs washer and dryer

- Want: smart home features

The original article was published by Zillow and posted at https://www.zillow.com/home-buying-guide/what-to-look-for-when-buying-a-house/