Saving to buy a house requires more than just saving for a down payment. You’ll need to think about factors, such as closing costs and moving expenses, to name a few. If you’re worried whether you’ll be able to set aside enough — putting down 20% is ideal — you’re not alone.

A 2021 Zillow survey (Consumer Housing Trends Report 2021) found that a majority (64%) of first-time buyers put less than 20% down on a house, and a quarter of those surveyed put down 5% or less. On a typical starter home priced at about $150,000, that would equate to $30,000 and $7,500 or less, respectively.

To help you get started, here are six suggestions on how to save for a house.

1. Estimate how much money you need to save

Figure out the amount you can comfortably afford to spend on a house to estimate how much you need to save. It’s generally advised to save up to 25% of a house’s purchase price in cash to cover upfront costs associated with buying a home. This will include*:

- Down payment: expect to need about 3-20% of the purchase price saved to cover the cost of a down payment.

- Closing costs: try to save about 2-5% of the purchase price to cover closing costs.

- Moving expenses: The average cost of moving a household is about $1,250 or $4,890 if moving long distance.

Example: Say you want to buy a house that costs $300,000, based on the above ranges, you’ll want to save between $9,000-$60,000 for a down payment, $6,000-$15,000 for closing costs and about $1,000 to cover moving expenses like a truck and packing supplies.

In order to cover upfront expenses, the amount you need to save can vary depending on the type of loan you qualify for, the purchase price, the location, your down payment amount, as well as several other factors. But don’t fret; a local or national lender can help you determine how much you should save for a house and how to do so in a time frame that works for you.https://www.youtube.com/embed/rZG62l-P67U?feature=oembed&enablejsapi=1&modestbranding=1&rel=0&showinfo=0

2. Calculate how long it will take you to save

The housing market is constantly changing. Only you will know when you’re financially ready to buy a home whether that’s in one year, two years or longer. If you don’t already have a deadline in mind, the amount you can currently afford to save monthly will help determine how long it will take to save for a house.

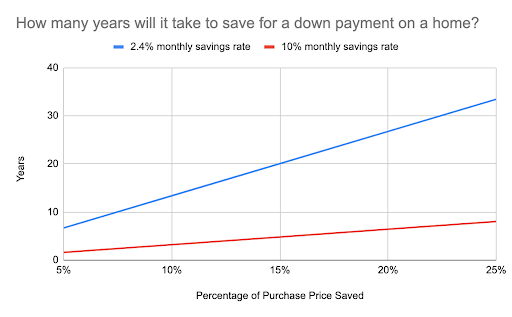

According to Zillow Research from 2021, for renters making the median U.S. renter income of $3,855 per month and putting 2.4% (or about $92/month) of their income into savings (the median rate for renters), it will take 27 years to save for a 20% down payment on today’s typical starter home, priced at $148,527. In seven years, they could accumulate a 5% down payment (almost $8,000).

With a more aggressive saving strategy, it is possible to reach a down payment goal more quickly. For example, by saving four times the current median rate, they could save a 5% down payment ($8,000) in two years or 20% (nearly $30,000) in six years. This savings rate equates to roughly 10% of their median monthly income or about $385/month. Keep reading for tips on how to boost your monthly savings rate.

The chart shows two down payment savings rates, 2.4% and 10%, for renters earning a median U.S. renter income of $3,855 per month. Down payment percentages are based on the purchase of a typical starter home priced at the median value of $148,527.

3. Open a high-interest savings account

It’s smart to have your money working for you while saving for a house. Consider saving your money in a high-interest savings account. While investing your money in the stock market is another option, it is typically a riskier, longer-term approach with no guarantee you will make money in the long or short-term. Instead, opening a high-interest savings account can help you earn some interest on your money without the risk of market volatility in the stock market depleting your savings.

4. Automate your savings

Pay yourself first. Most people wait until the end of the month to save, but you risk spending that money between payday and the month’s end. Instead, try setting up a recurring transfer from your checking to your savings account — a good rule of thumb is to automate the transfer based on your paycheck cycle. If you get paid on Friday every week, have a set amount automatically transferred from your checking into your savings on that day. That way, you’re not tempted to spend it.

5. Find ways to save a little more each month

The fastest way to save for a house is to increase the amount you put into savings each month. Here are some tips to save for a house more quickly.

Reduce your monthly expenses

Reducing your monthly expenses is helpful because you can direct those savings toward your future housing costs. To start, look at your bank and credit card statements to identify money coming in and going out. Scrutinize your expenses to see where you may be able to cut or minimize non-essential spending. For instance, you can cancel subscriptions you don’t use, buy generic products instead of name brand items, or pack a lunch instead of eating out.

Other ways to reduce expenses is to look at your essential spending to see how you can lower those bills. For instance, you can shop around or bundle policies for better auto insurance prices, negotiate a lower internet bill, refinance personal loans at a lower rate, or, if you own multiple vehicles, transition into using only one-car if possible.

Pay down your debt

The debt you owe can impact your ability to save because a portion of your income is designated to those debts each month. Pay off any credit cards with high interest because the longer you maintain that balance, the more it ends up costing you in interest. If you have any low balance debts you may choose to pay those off completely to avoid continued interest payments. Don’t get too hung up on the larger debts for now.

Stay consistent. Each time you pay off a debt, act like you still have the payment and send the cash to your house savings account. Paying down your debts may help you improve your chances of qualifying for a mortgage when you’re ready to buy because it lowers your debt-to-income ratio (DTI) and can improve your credit score.

Earn additional income

While receiving a tax refund, cash gift or a bonus at work will definitely help, earning additional income will help you save for a house much faster. Side hustles are a savings strategy, but be sure to maintain your primary source of income. Your lender will consider all your income sources when qualifying you for a home loan.

Here are some ideas to pursue:

- Rent out a spare room or parking space

- Take up a part-time or weekend job (e.g., being a driver for Uber/Lift)

- Ask for a raise at work

- Sell a big item like a car/furniture

6. Track your savings progress

Use a spreadsheet or an app like Mint or You Need a Budget to keep track of your progress. You may have access to a free tool within the mobile app for your bank account. You’ll know exactly how much you’ve already saved as well as how much more you have to set aside. Seeing your savings progress keeps you motivated and makes saving less stressful.

Now that you know how to save for a house, estimate your monthly mortgage payments with our mortgage calculator.