How this non-traditional path to ownership leads to substantial savings and surprising community.

For most new homeowners, getting the key to their own home means saying goodbye to roommates they lived with during college or while building job experience.

And then there are homeowners like Christine Knapp, who began posting online for a roommate soon after receiving her master’s degree and buying a home. Knapp says renting out a room allowed her to eat something other than ramen every night as she started a new job as a public school teacher.

“I thought, if I’m paying rent every month, I can put that much money into a mortgage,’’ she says. Having a roommate gave her a financial cushion and some breathing room as she built her career.

Eight years worth of roommates later, the decision is still paying off — and represents a trend among today’s younger homebuyers, who are embracing “house hacking” as a way to lower the cost of housing.

A recent Zillow® survey found that 55% of Millennial and 51% of Gen Z homebuyers say it’s very or extremely important that they have an opportunity to rent out part of their home for extra income while living in it. For all homebuyers, the share was 39%, up 8 percentage points in the past two years.

With interest in renting growing among homebuyers, we talked to Knapp and three other homeowners who live with roommates or rent out part of their home to see how they did it and some of the lessons they learned along the way.

While renting out a room or taking in roommates isn’t for everyone and comes with its own challenges, these four homeowners have made it work for them.

Meet the homeowners

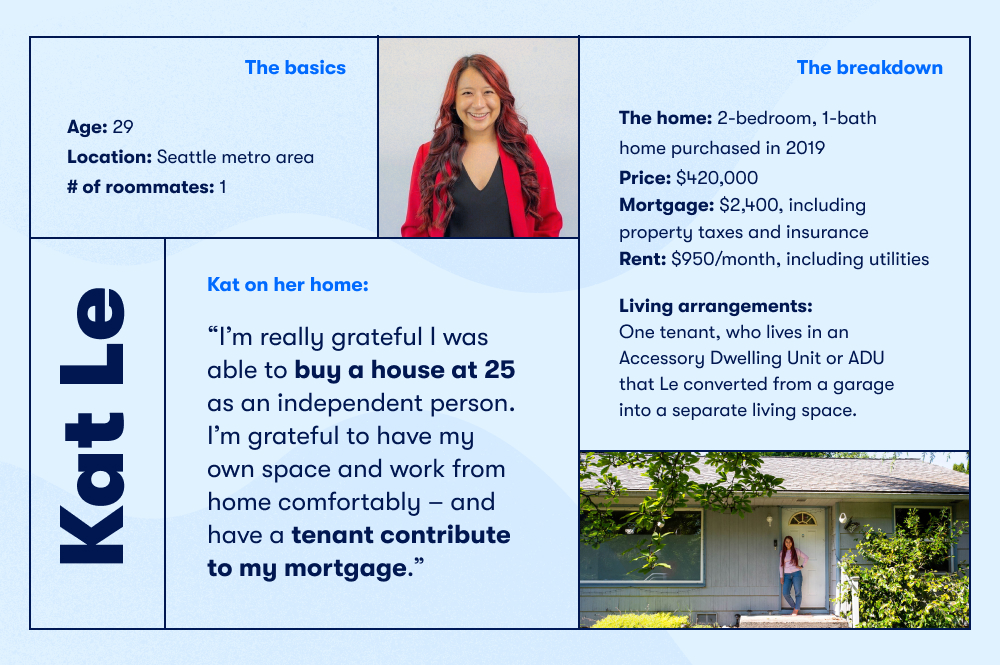

1. Kat Le: ‘I want to be able to go back somewhere’

Living arrangements: She rents out her ‘casita’, a.k.a. a converted garage, to a family friend

Kat Le knew she wasn’t buying her “forever” home when she purchased a house in the suburbs that she now shares with her partner, some chickens and her three large rescue dogs. She’ll even tell you she didn’t particularly like it that much. Yet, the price and the location were right, and she figured she could update it over time as she and her partner lived there.

The rambler, which sits on a quarter acre, came with what the previous owners described as a “bonus room” in a detached garage. Using materials from a building salvage store, Le’s partner turned the room into a “casita,” or accessory dwelling unit with its own kitchen and bath.

“I thought it was going to be for one of our parents to live in,” she says. “The thought didn’t enter my mind to have a renter.”

Her partner’s father rented the casita for a year before moving to Canada. After he moved, Le left the space empty for a while before deciding to rent it to a single dad her partner had known for more than 10 years. The rent: $950 a month, utilities included — a bargain for the area.

Le could probably charge higher rent, but after watching her single mother struggle financially to raise her, she says she feels good making life easier for another single parent. She also hoped the lower rent would make the tenant want to stick around, creating a stable living situation for both of them. And though she can afford the mortgage without the rent, the extra income gives her even more breathing room, she says.

Le and her tenant share a common backyard, but otherwise, they each enjoy their private space. When she travels, her tenant helps keep an eye on the house and dogs while her house sitter is at work, but she says there is no obligation for him to contribute beyond paying rent.

Le doesn’t have a formal lease with her tenant, despite friends telling her she’s foolish not to. She’s not particularly worried about it.

“It’s a casual situation,’’ she says. “I trust him.”

For Le, the home represents an investment in her future. If she decides to move elsewhere, she’s confident she’ll be able to rent the house and the casita for more than the mortgage. That opens up a lot of options for the present — and the future.

The house isn’t her forever home, she says, but she has no plans to sell it. Who knows? Maybe one day she’ll even live in the casita.

“I want to be able to go back somewhere,’’ she says.

Kat’s lessons:

- Track your rental income and expenses on a spreadsheet to make tax preparation easier. Note that renting out a room or ADU comes with tax implications that you should consider. Please consult your tax advisor for advice regarding your individual tax circumstances.

- Add rental coverage to your homeowners’ insurance.

- Set clear boundaries for shared spaces and communicate clearly what you are and aren’t responsible for. For instance, if utilities spike over the typical amount, you can agree that your tenant or roommate will split the excess charges

2. Linden B. Henderson: ‘I want to have a sense of found family’

Living arrangements: A four-bedroom room with four roommates who share common spaces

Linden B. Henderson never liked the power imbalance built into the landlord-tenant relationship, which is why they set out to create a different dynamic when they bought their home in 2021.

“I want to live here with other people,’’ Henderson says during a break from yard work. “I want to have a sense of found family, or at least connectedness, and I want this to be a place where I can have a stable life, which has helped my mental health immensely. I want to share that with other people, and have this house be a vehicle for doing things in a better way.”

The idea of buying a house seemed like a pipe dream to Henderson until a friend relayed how she had bought a home with the help of a down payment assistance program. Intrigued at first, and then determined to follow through, Henderson worked to establish a solid credit history and began taking a first-time home buyer class required to qualify for a down payment assistance program in their area.

Henderson was still taking the online class when their parents offered to co-sign for a mortgage and provide them with a 10% down payment toward the purchase so long as Henderson would pay the mortgage. Their parents, who had helped out with rent during the pandemic when Henderson’s consulting business dropped off, figured it made better financial sense to put that money into a house.

Finding a home with four bedrooms allowed Henderson to live their dream of cohabitating collectively while keeping rent affordable for everyone. Seeking to create a more egalitarian environment and live by their values, Henderson is intentional about sharing decisions with their roommates and splitting expenses equally. To that end, expenses are divided with equity in mind. Henderson, who has the largest bedroom, pays $900 a month; the three roommates who live in the main house pay $800, utilities included. The fourth roommate, who occupies the converted bedroom, doesn’t pay rent but helps around the house.

When Henderson bought the home, they estimated that a $10,000 “house fund” would be enough to keep up with the cost of repairs and maintenance. They quickly blew through that, and now, a portion of the rent is deposited into the fund every month so that everyone shares in the house’s upkeep. Henderson and two of their roommates are handy, so they fix or improve whatever they can to keep the rent down. At first, there were no leases, only verbal agreements. But recently, everyone agreed to a month-to-month written lease.

Everyone shares chores and participates in weekly household meetings to discuss logistics and work through issues. Still, if there’s a conflict that can’t be resolved, Henderson is painfully aware that they have the final say.

“One way you deal with it,’’ they say, “is by acknowledging that the (dynamic) exists.”

Owning a home is a lot of work — more work than they were prepared for, says Henderson. But the biggest challenge, they say, has been setting and enforcing boundaries so that everyone can live harmoniously.

Linden’s Lessons:

- Building community is challenging. Two roommates moved out when they couldn’t agree with COVID safety protocols that Henderson insisted on after two bouts of the virus left them with symptoms of long COVID.

- Be clear-eyed about financial decisions and realize you have to pay for a lot more things than just the mortgage.

- Set aside time to think through issues as relationships evolve.

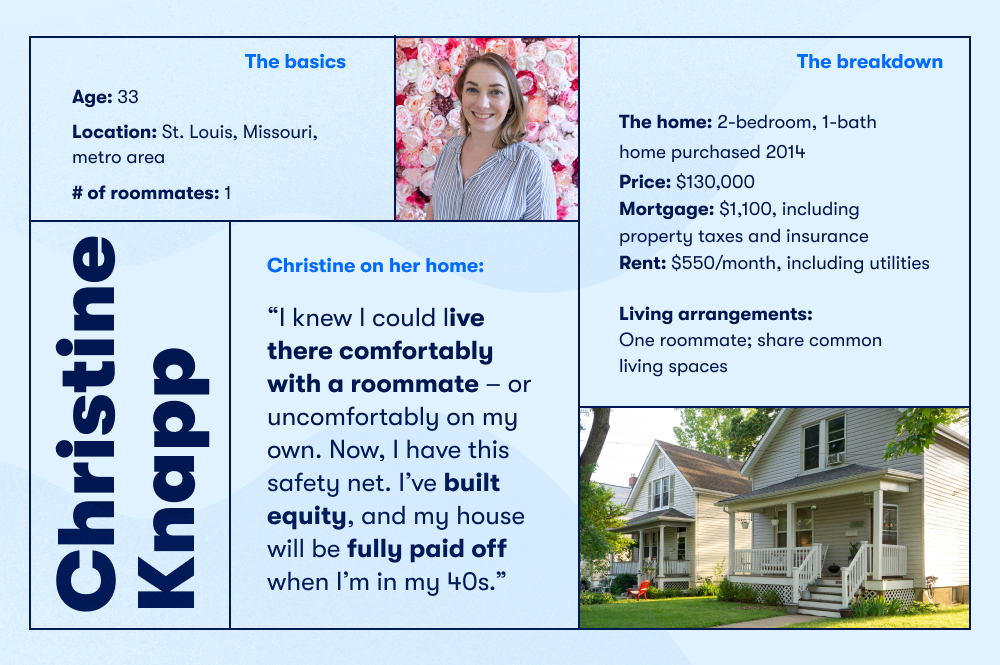

3. Christine Knapp: ‘I knew I could live there by myself … eating ramen’

Living arrangements: A 2-bed, 1-bath single-family home shared with one roommate

Christine Knapp was earning a public school teacher’s salary in 2015 when she decided to buy a home in the St. Louis metro area. Having recently completed grad school, she’d grown tired of living in rundown rentals in college towns and wanted more control over her living situation. Rather than wait for her dream home or a partner to buy with, she struck out on her own, buying a recently rehabbed house directly from the couple who was selling it.

“I knew I could live there by myself, eating ramen and having no disposable income,’’ she says. “But I always had the intention that the second bedroom would be rented out. I knew there was a market for that.”

Eight years later, Knapp is sitting on a ton of equity. She’s also enjoying stable monthly payments and financial breathing room while opening up possibilities for passive income should she decide to rent out the house in the future.

“Some people are more afraid of buying a house than getting married,’’ she says. “It’s not an end-of-the-world decision. You’re not tied to it ‘till death. If your life changes, if your situation changes, you can sell it.”

Knapp has had three roommates since buying the home. The stylish décor is primarily Knapp’s, and chores and cleaning are shared in ways that both parties agree to. Some people need a schedule or rules, she says, while others have already learned to pick up after themselves.

Knapp and her roommate each have their own bedroom, but share a bath and common spaces. “It’s similar to when you’re in college, except when something breaks, I have to fix it,’’ she says, laughing.

Finding roommates has proven relatively easy, says Knapp, who has found her roommates through online posts. She vets potential roommates for compatible lifestyles, works to set clear boundaries and communicates early and openly if there are problems. Knapp says her last roommate was a medical student who spent most of his time studying. She and her tenant don’t need to be best friends in order to have a peaceful, harmonious living situation where each person is invested in keeping the good vibes going.

“You need to find someone you’re safe and comfortable living with,’’ she says.

Knapp’s journey has had its challenges, she says, including expensive repairs to her home’s electrical system and sewer pipes within two months of moving in. Knapp says she’s lucky to have a father with a wide variety of DIY skills, which helps when big things break. Maintenance remains a challenge, but having roommates has helped offset those costs over the years, providing her with extra income for savings and enjoying life.

Christine’s Lessons:

- “Don’t look for perfect,’’ says Knapp. “There’s no perfect house. It’s up to you to make it perfect to your liking.”

- Buy what you can comfortably afford, not necessarily the maximum amount you qualify for.

- Adopt a safety protocol when searching for roommates. Don’t give out your address for the first meeting. Instead, meet at a public location and bring someone with you. Ask for their driver’s license, check references and run a credit check.

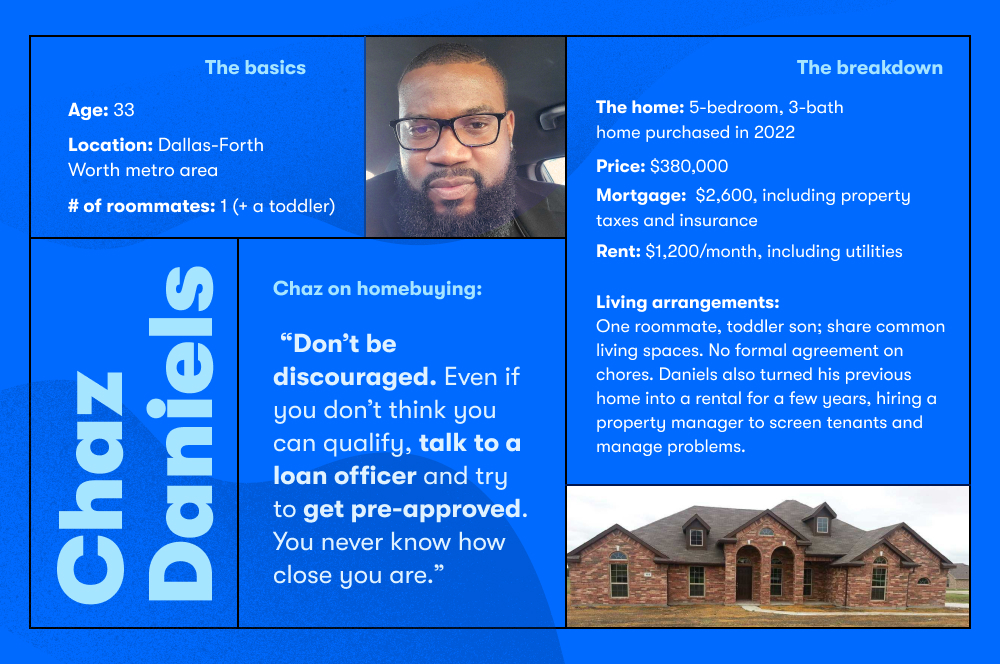

4. Chaz Daniels: ‘These are assets and generational wealth builders’

Living arrangements: He shares a 3,100 square foot home shared with a roommate and his toddler.

Chaz Daniels set out to build wealth through homeownership at a young age, buying his first home in Texas when he was barely out of college at 23.

Even at that age, Daniels had a goal: “How do I make more income without making more income from a job?” His subsequent experiences as a landlord and the passive income that comes with it have made him more determined to continue to invest in properties that he says can help him meet his lifestyle goals for the future.

Daniels bought that first home in 2014, when he and his then wife paid $200,000 for a large house on a one-acre lot in a Dallas suburb. A year into the purchase, the couple began questioning the uneventful lifestyle that came with it. “We were like, ‘Why did we buy this house?’ We felt old,’’ says Daniels.

Instead of selling, the couple put the house up for rent and moved closer to the city. They hired a property manager to advertise and vet prospective tenants and to manage the home so they didn’t have to chase down contractors or tradespeople whenever something broke, Daniels says.

Renting to a tenant proved to be a learning curve. They signed a two-year lease to minimize turnover, which Daniels now says was a mistake because the longer lease didn’t allow them to see whether the tenants would take care of the home. They also had a difficult time when they later needed to sell the house and the tenant was living there. Still, Daniels says “we netted $500 a month on the property” while they were renting it out.

Daniels and his wife split up, and he bought another home on his own in August 2022 — a 3,100 square foot house in the Dallas-Fort Worth area. The house felt empty with only him and his toddler son living there, he says, so he opted to rent out a room to a female relative for $1,400 a month, including utilities.

The home’s size leaves plenty of room for privacy, even with common areas such as the kitchen and living room, Daniels says. They share occasional meals, and while they don’t have a formal arrangement for chores, they have an understanding that each person will take care of their own messes.

Daniels views his home primarily as an asset, one that can generate passive income for him now and in the future, should he decide to eventually rent out the entire home. But he’s also begun to think of the house as the family home, a stable place where he can raise his son and share memories.

“I could see myself staying here longer,’’ he says.

Hiring a property manager taught Daniels some valuable lessons about being a landlord, he says. His experiences with renting have been so positive that he is now looking to buy a duplex as an investment rental.

“These are assets and generational wealth builders,’’ he says. “The more you can capitalize on it, the better off you are.”

Chaz’ Lessons:

- Consider buying a multi-family home as your first property, says Daniels. “If you’re going to be renting, you’re probably going to be renting an apartment. The monthly rents are increasing, so why not buy a duplex as your first home?”

- Let your loan officer help you determine what you can afford. Tell them if you have plans for roommates or to eventually rent out the entire home.

- Find a real estate agent who is familiar with the rental market in your area. If you’re looking for a multi-family home to buy, ask the agent how they have helped other buyers of similar properties.

What to know about financing a home purchase with rental income

Talk to your lender if you’re planning to rent out a room or ADU to see whether you can count future rental income to qualify for a home loan.

Circumstances, experience as a landlord, and the type of home you want to buy all influence the type of financing that might be available to you, according to Tim Weiler, director of Mortgage Credit Policy at Zillow Home Loans. He offers the following general guidelines and a reminder that a lender can give you information specifically tailored to your plans and circumstances.

Can I use rental income to qualify for a mortgage?

Yes, but only under certain circumstances. The rules vary for different types of loans and the types of properties you are financing. Here are a few to know.

Conventional and jumbo Loans backed by Fannie Mae and Freddie Mac

If you don’t currently own a home, you can’t count rental income to qualify for a mortgage with this type of loan. This doesn’t mean you can’t have tenants to offset your monthly payments; it just means that you will not be able to count rental income to help qualify for the loan.

Conventional Loans for a single-family home that you will live in that has an Accessory Dwelling Unit (ADU)

Fannie Mae, the federally backed mortgage institution, will allow you to count 75% of the rental income from an ADU as an exception under its HomeReady Program, which requires your qualifying income to be less than or equal to 80% of the average median income in the area where the property is located. For a detailed look at income requirements for Fannie Mae loans, see this document.

Freddie Mac will allow you to include rental income on your application for a purchase, with a number of conditions. For example, first-time buyers seeking to use this loan type are required to participate in a landlord education program. Rental income cannot make up more than 30% of the total income you need to qualify for a mortgage.

FHA loans

Federal Housing Administration (FHA) Loans require you to live on the property. The loans can be used to buy a single family residence that has an ADU and properties with up to four units. There are no income limitations, and you are not required to have a prior history of rental income.

VA loans

Veterans Administration (VA) loans allow you to count rental income from the home you’re planning to move from, even if you don’t have a history of owning investment properties.

Jumbo loans through the VA do not allow you to count income from an ADU.

I’m planning to move from my current owned home and obtain a new mortgage. Do I need a signed agreement or other proof that a roommate will be contributing toward the mortgage?

Fannie Mae, FHA and VA each have guidelines permitting the use of rental income from a roommate. In order to qualify for a loan, you need to have collected rent for two years in your current home, have reported that income on your tax returns and have proof of those payments.

Freddie Mac only permits income from a roommate when that person is a live-in aide. That income can only account for up to 30% of the total income needed to qualify for the loan. A minimum history of 12 months of documented income is required.

Jumbo loans do not permit rental income from a boarder/roommate.

If I’m not using my rental income to qualify for a loan, do I have to tell my lender that I’ll be charging rent?

You’re not required to, but it might help in determining how much you can comfortably afford. Some buyers want to buy the biggest house they can afford, even if it means scrimping on everything else. Others are looking for the lowest monthly payment. It helps your lender to know what your thinking is.

Do the rules differ if I’m buying a single family home versus a duplex/triplex/apartment building, etc. that I plan to live in as my primary residence?

The rules are basically the same, although HUD/FHA has the “self-sufficiency” rule that says the rental income from the units occupied by tenants must equal at least 105% of the mortgage payment, including taxes, insurance and homeowners association fees.

What other considerations should I be aware of?

Check with your lender to see what they require. For instance, Zillow Home Loans will typically ask for a copy of the deposit check from the tenant if a lease is provided when there is no history of rental income. The information on the lease also will be validated since submitting a “fake” lease is considered mortgage fraud.