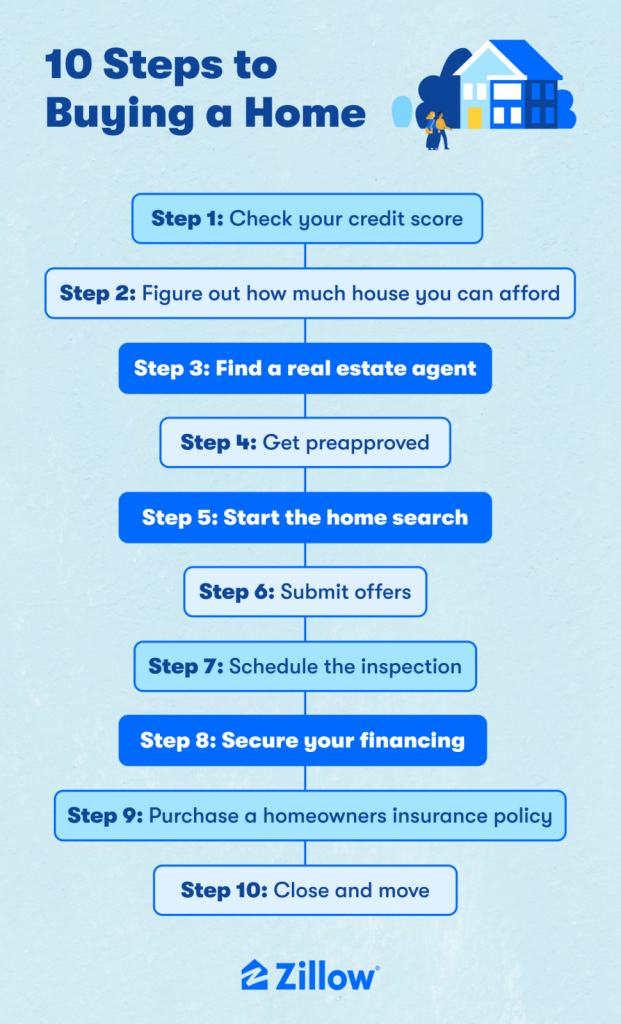

Buying a house can be a complicated, stressful process. Here are 10 steps to help you confidently find your new home.

Buying a home can be stressful during the best of times, and it might feel positively overwhelming in a highly competitive market. Although a few of the details may look different right now, the overall process of buying remains the same — and understanding the key steps can help you reach your goal and make your dream a reality.

No matter when you plan to buy, there are a few things you should know. On average, the process of buying a house takes roughly six months. In 2021, the typical buyer reported searching for between 2 and less than 3 months. Then add to that 30-45 days to close.

But the process of buying a house includes more than just touring homes. You also need to review your credit and financing options, find the right real estate agent, make offers and negotiate, get an inspection, prepare to move and, eventually, close on your new home.

Where to start when buying a house

Some of the first things to consider when you’re buying a home are how much you want to spend, where you’d like to live and what’s important to you as a buyer. Here a few questions to ask yourself:

- How much house can I afford?

- Am I going to take out a loan?

- How much do I have saved for a down payment?

- Can I afford my desired neighborhood?

- Are home values increasing or decreasing in the neighborhood?

- How long will my commute take?

- Is the school district a fit for my family?

- Is it within walking distance to amenities and activities?

Once you have the answers to these questions nailed down, you can start your home search.

Here are the 10 most important steps to take when buying a house.

Step 1: Check your credit score

Before you permit a lender to check your credit score, you’ll want to do a thorough review of your own credit report.

What is a credit report? A credit report pulls data from three major credit reporting agencies: TransUnion, Equifax and Experian. It is the report used to calculate both your FICO score and your Vantage score.

You can get free reports from all three reporting agencies, at least once each year. If you find any errors in your report, dispute them immediately so they can be resolved before you apply for financing.

What is a FICO score? A FICO score is the score lenders use to evaluate your creditworthiness. This is calculated by Fair Isaac & Co. and ranges from 350-850.

What is a Vantage Score? A Vantage Score is the credit score you’ll see when you check your score on consumer-facing credit check websites. Your Vantage Score can vary from your FICO score. Lenders do not use your Vantage Score to evaluate your creditworthiness.

The higher your credit score, the lower the interest rate you’ll receive. Generally speaking, a credit score of 720 or higher will get you a good interest rate on a conventional loan, but qualification criteria depends on the specific lender. For FHA loans, you can usually get approved with a credit score of 580 or higher.

If you’re trying to improve your credit score before applying, you should understand factors that can impact your score:

- Payment history

- Total debt

- Length of credit history

- New credit

- Type of credit

Step 2: Figure out how much house you can afford

When you get pre-approved, your lender will tell you the maximum amount you’re able to borrow (we’ll talk more about the pre-approval process later). But you don’t need to wait for the pre-approval to get a general sense of what you can afford. The Zillow Home Affordability Calculator can help guide you to the right price range, taking into consideration your annual income, monthly debts and projected down payment amount, among other criteria.

Prioritize your wish list to fit your budget

Once you have a rough budget in mind, make a list of must-have home features. Your price point will likely dictate the size, location and amenities of your future home. Here are a few examples of wish list items to consider:

- Number of bedrooms and bathrooms

- Square footage

- Outdoor space

- Preferred location

- Type of home

- Layout, features and finishes

- School district

- Pet-friendliness

- Work commute

Step 3: Find a real estate agent

Most buyers find it helpful to have a professional real estate agent on their side to guide them through the process. In 2021, 82% of buyers used an agent during some part of their home search, according to the Zillow Group Consumer Housing Trends Report 2021. Typically, sellers fund the buyer’s agent commission, which makes using an agent a cost-effective option for buyers.

Here are some areas where a buyer’s agent can help:

- Market insights: identifies home value trends, new developments, buyer demand and overall state of the market

- Offer price: determines what a home is worth and recommends a competitive initial offer amount

- Negotiating: knows when to argue for a lower price and how to negotiate contingencies and repairs

- Local familiarity: has insider tips about the neighborhood and area schools

- Professional recommendations: provides referrals for a trusted lender, attorney, contractor or other vendors

- Experience: simplifies the process by handling hiccups, staying on top of due dates and overseeing paperwork

Of course, you want to make sure you find the right agent. A 2022 Zillow survey found that 24% of recent home buyers said they wished they had hired a different agent. Use Zillow’s Agent Finder to search for local agents, read customer reviews and check out an agent’s recent sale history before interviewing your top two or three candidates.

Step 4: Get pre-approved

Unless you’re buying a home with all cash, getting pre-approved by a lender will give you an official verdict on your home buying budget. Some 86% of sellers prefer a buyer who has been pre-approved, as opposed to pre-qualified, for a mortgage, according to a 2022 Zillow survey.

In order to get pre-approved, a lender will calculate your debt-to-income ratio and assess your overall financial health by reviewing your:

- Income statements, like W2s, 1099s, rental income and tax returns

- Assets, like bank statements and retirement accounts

- Debts, including monthly expenses like student loans, credit cards and other mortgages

- Records of bankruptcies and foreclosures

- Current rent, child support payments, alimony payments and any down payment gifts

When you’re pre-approved, you’ll receive a pre-approval letter. Not only does it officially let you know how much you can borrow, but it can come in handy when submitting an offer. A pre-approval letter shows a seller you’re serious about buying their home. This is especially important in a hot market, when you’re likely competing against other offers.

Note that you do not have to use the same lender to finance your loan that you used for your pre-approval. In fact, it’s always best to get estimates from multiple lenders and compare interest rates and fees before actually opening your mortgage.

Research from Zillow shows some buyers can save tens of thousands of dollars over the course of their loan if they shop for the best rate. Just one percentage point in higher interest could add more than $200 to a monthly payment on a typical U.S. home, and nearly $75,000 over a 30-year mortgage. Buyers can compare multiple lenders on Zillow’s online mortgage marketplace.

Keep in mind that your debt-to-income ratio will be examined again before closing. Taking on new debt can limit the total loan amount available to you during financing.

Step 5: Start the home search

Searching available homes online is a great way to start your house-hunting process. According to the Zillow Group Report, 95% of buyers use online resources in their home search. Start on Zillow and search for homes in your target area, then filter by price and your must-haves. Additionally, your agent can send you listings and schedule showings.

Try to stay flexible — you’ll probably need to adjust your criteria as your home search continues. For example, you might decide it’s worth sacrificing an extra bedroom to be in your desired neighborhood. Play around with search parameters and see what your money would buy if you changed your wish list a bit.

What to look for when touring homes

Once you start visiting homes in person, be sure to consider the home’s “health” so you’ll have an idea of any major challenges that might be coming your way if you decide to make an offer. Ultimately, the inspection will give you an official report on the home’s quality and condition, but while you’re touring, keep an eye out for the following:

- Structural defects and cracking

- Water pressure (turn on faucets and shower heads)

- Electrical issues (try the light switches)

- Functionality and heat retention of doors and windows

- Roof and exterior quality

- Noise from neighbors or traffic

Step 6: Make an offer

Once you’ve found the right home, you should make your offer based on a comparative market analysis (CMA) done by your agent. The CMA is a calculation of a home’s market value based on comparable recent sales in the same area.

Using the CMA as your baseline, your agent should help you determine a fair offer price and help you decide if you should leave some room for negotiation — this depends on the state of your real estate market.

Above and beyond the CMA, here are some other things to take into consideration when making an offer:

Disclosures: Disclosures are known problems related to structural issues, unpermitted work, natural hazards and flood risks. Most states require sellers to provide disclosure documents, so make sure your agent requests them.

Closing date: When you’re buying a home with a mortgage, it will take 30-45 days after the contract is executed to close on the home. When you submit an offer, you can request a later closing date to fit your moving timeline, but the seller may push back on this request.

Contingencies: A contingency is an agreement between the seller and the buyer or the lender and the buyer regarding conditions that need to occur for the sale to move forward. Some contingencies are necessary, like the appraisal contingency your lender will require to ensure they’re not overpaying on your loan. An inspection contingency is up to you, but it’s highly recommended. Zillow’s Consumer Housing Trends Report finds that 88% of successful buyers won their home without waiving the inspection.

Earnest money: An earnest money deposit is a sum of money you’re willing to put down when you make your offer to show that you’re serious about buying the home. If you close on the home, the earnest money simply becomes part of your down payment. If you back out of the purchase (outside of a contingency), you’ll lose the deposit.

It’s important to note that not every offer works out. It can be disappointing, but try not to feel discouraged if you don’t get the first home you put an offer on. In fact, 59% of buyers who submitted an offer ultimately made multiple offers before successfully closing on a home, according to the Zillow Group Report.

Step 7: Schedule the inspection

Eighty-eight percent of buyers conducted an inspection on a home they were buying, according to the Zillow Group Report. Including an inspection contingency and completing a home inspection are the best ways to ensure the home you’re buying doesn’t have any major underlying issues.

Your real estate agent should be able to recommend a trustworthy, licensed home inspector, or you can search Zillow’s professional directory and select an inspector based on home buyer reviews.

Usually, the inspection is scheduled within a week of the contract being signed. It’s recommended that you attend the inspection, as it’s a good way to get a better understanding of the inner workings of the home. Usually, your agent will attend as well. After you receive the official inspection report, you’ll have time to discuss the findings with your agent and decide how you want to respond to the seller.

If major, non-cosmetic issues are found, you can reopen negotiations, requesting that the seller pay to fix the issue prior to closing or provide you a credit so you can fix it on your own after closing.

Step 8: Secure your financing

Even if you’ve been pre-approved, you still need to take a few additional steps to officially submit the mortgage application. Once you’ve completed the following steps, assuming everything checks out, you should receive the “clear to close,” which means that the lender has approved your purchase.

Loan application

If you decide to officially apply for your loan with the same lender that did your pre-approval, they already have some of the documents you’ll need for your application. Likely, you’ll need to provide updated financial statements. The most important thing you can do during this process is to respond to requests quickly. For example, if the lender asks for your W2, send it promptly to avoid a delay in your closing. If you decide to move forward with a different lender, they will tell you the list of documents they need in order to complete your application.

Appraisal

Your lender will hire the appraiser, so there’s not much for you to do here. Your real estate agent should work with the seller’s agent and the appraiser to schedule the appraisal. After the appraisal is complete, you and your agent will receive copies of the appraisal report, so you can see the appraised fair market value and check out the comps that were used in the calculations.

If the appraisal matches your offer price: You should be clear to close.

If the appraisal comes in above your offer price: Even better! This means not only are you clear to close, but you’re purchasing the home for a price below market value, giving you instant equity.

If the appraisal comes in low: Your lender won’t approve the full loan amount, as in their eyes, you’re overpaying for the property. You’ll need to either make up the difference between the appraised value and the offer price in cash or try to re-negotiate the offer price with the seller. If you believe the appraisal was incorrect, you can try to request a new appraisal from your lender.

Step 9: Purchase a homeowners insurance policy

You’ll need to have proof of a homeowners insurance policy before closing, so if you already own a home, ask your existing agent to help you open a new policy. If you don’t own a home, shop around for a policy that works best for you. Your lender may be able to help you coordinate a policy that can be paid through your monthly escrow account.

Step 10: Close and move

Many buyers choose to have a final walkthrough a day before or the morning of closing. Its purpose is to be sure that the property looks the same as when you made your offer and that the seller completed agreed-upon repairs (if applicable).

On closing day, expect to spend at least a few hours at the title company signing paperwork. You should also be prepared to bring funds to cover your closing costs, which typically range between 3-5% of the sale price.

Once the signing is complete and the sale is recorded, you’ll receive your keys. The house is yours!

You can now set up utilities for the new home — things like electric, cable and internet. If you’re buying a condo with an HOA that covers some utility costs, double check contract responsibilities with your real estate agent.

Finally, get ready to move and settle into your new home.